Tax form W-8BEN reference

This tax form is for individuals residing outside of the United States.

Certificate of No U.S. Activities

Review the information on the Certificate of No U.S. Activities page. If the information is correct, enable the acknowledgment checkbox and sign.

- The name in the signature must match the name in the certification text. If this name is incorrect, contact Unity Support.

- If the information on this page isn’t correct because you perform services in the United States, select Not Applicable.

If you performed services in the US, you must complete and upload Form 8233. For more information, refer to the IRS document Instructions for Form 8233.

Important: If you rendered services in the US, your payouts might be subject to a withholding tax of up to 30%.

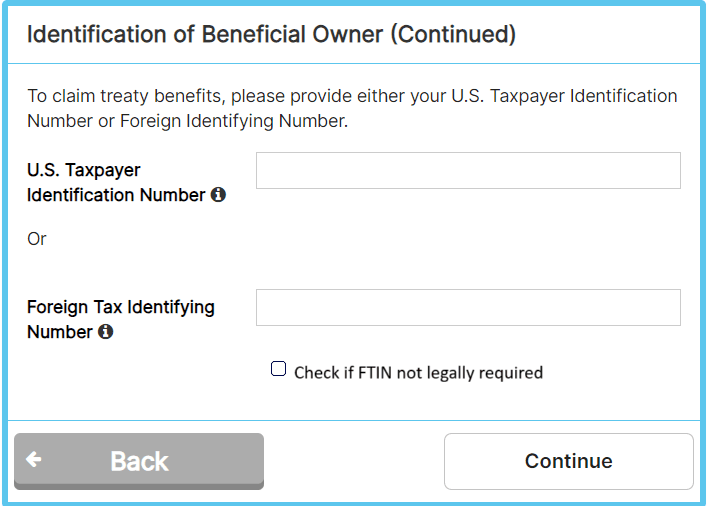

Identification of Beneficial Owner

Enter your information as prompted by the form. For more information, refer to the IRS document Instructions for Form W-8BEN.

If your country doesn’t assign tax numbers to individuals, enable the Check if FTIN not legally required checkbox.

Claim of Treaty Benefits

Enter your data as prompted by the form.

Note: If you can't find your country in the list of treaty countries, this means that your country does not have a tax treaty with the US and you can skip this section.

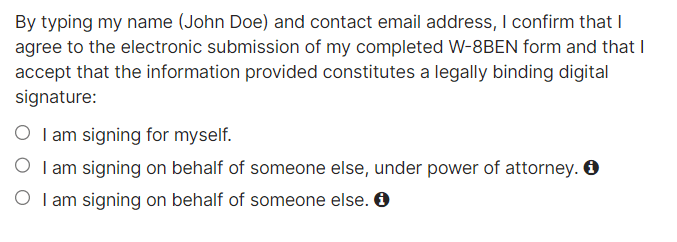

Certification

Review the information on the Certification page, and if it’s correct, enable all checkboxes. If any information is incorrect, this might mean that you have either selected the wrong form or have answered some of the questions incorrectly.

Select the option that describes how you’re signing the form. If you’re signing on behalf of someone else, you need to provide either a power of attorney or a valid explanation (for example, signing as the parent of a minor).

Enter your name and email address in the signature fields. This information must match the name and email that you previously entered on the Address page.

When you have confirmed that all information on this page is correct, select Submit Form.

Additional Documents or Explanations

In certain scenarios, you might be prompted for additional documents or explanations, such as if you claim that you are a non-US resident but your address is in the US or bank account is in the US, or if you are signing on behalf of another person. This includes scenarios where you use services such as Payoneer or Wise to receive payouts, because these services operate by using US bank accounts.

Note: Additional documents are manually reviewed. Allow up to seven business days before your account is activated.